By Emma Negrei at Evans and Partners

The Retail Trends Survey of retailers and wholesalers across the industry gives us an early overview of retail conditions in the preceding quarter. These are the results of the 94th survey reflecting conditions in the June quarter 2017.

For a full copy of the report or to be involved please contact Emma Negri enegri@evansandpartners.com.au

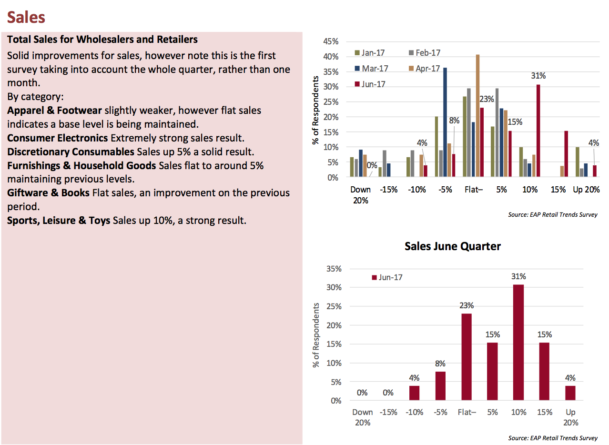

Sales

·Strong sales results with nearly a third reporting sales up 10% and two thirds reporting sales up 5% or more.

·Consumer Electronics and Sports Leisure and Toys reported the strongest sales numbers, up 10%.

·Discretionary Consumables and Furnishings and Household Goods also reported strong sales up 5%.

·Apparel & Footwear and Giftware & Books were both flat.

·Basket size and Foot Traffic were both broadly flat.

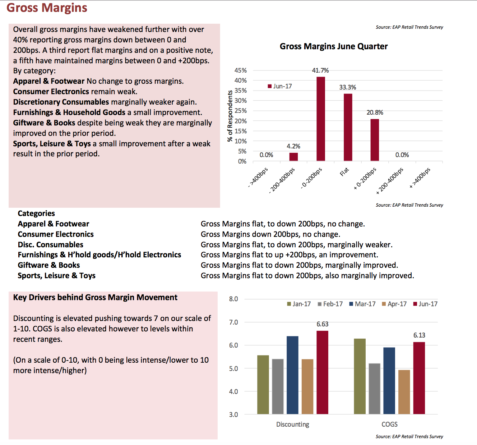

Gross Margins

·Overall gross margins have weakened slightly, with most now reporting margins down between 0-200bps.

·Discounting and COGS increased.

Balance Sheets

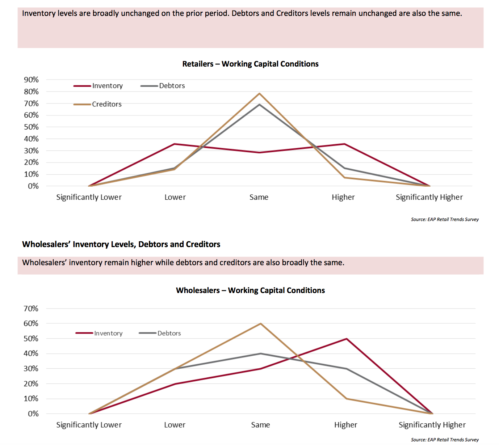

·No change to Retailer’s inventory levels with equal numbers reporting inventory as either slightly lower, flat or slightly higher. Wholesalers’ are reporting higher inventory levels.

Outlook

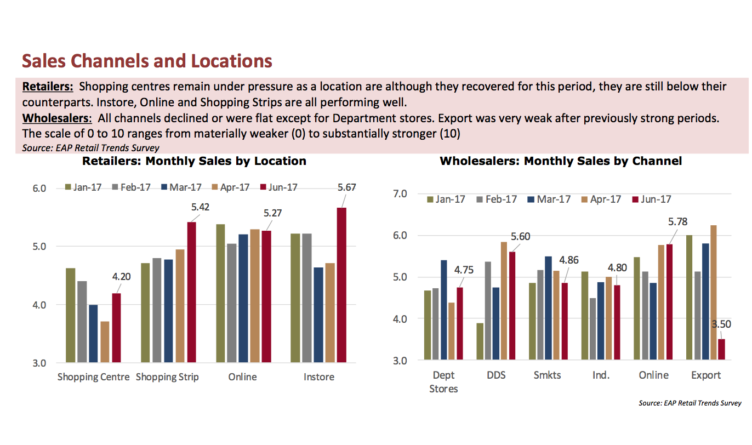

·The 3 month outlook is extremely optimistic. AS for business pressures, consumer sales remains the #1 pressure. Discounting is the #2 pressure, while online competition at nearly 25% increases as a concern. Shopping centres as a sales channel have been consistently trending lower for the past 5 months and this quarter improved but still lags behind other locations.

Commentary

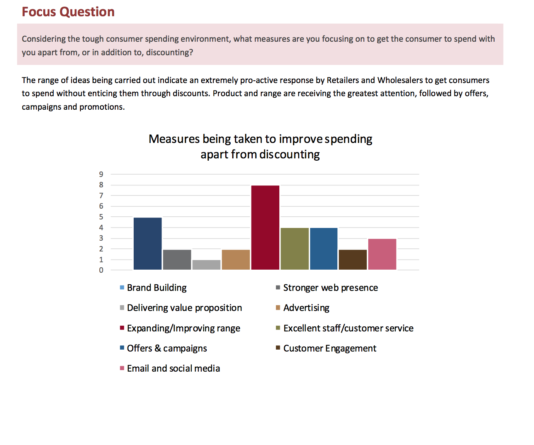

·Sentiment this quarter is quietly optimistic. Retailers and Wholesaler’s I’ve spoken to are embracing the challenge possibly posed by Amazon and as seen in our focus question are responding with initiatives and ideas to encourage the consumer to spend.