Building a strong vibrant retail product offer to survive tough retail trading conditions.

By Ken Tickle

A structured category hierarchy, a well thought through product range plan and protection of your final gross profit margins are the core strategies to profitable retailing in 2015. Retailers can no longer buy “lots, heaps and plenty” hoping that they get some of the product right for their customers. Final margin must be protected in a falling sales environment by disciplined retail management principles in the business.

There are major headwinds in managing your retail business for profitable outcomes in 2015. Disciplines that you must embrace in your business are:

- Achieving a high first margin or buying margin on your purchases. The drop in the Australian dollar will make purchases more expensive resulting in possible quality decline, to maintain the price point or increase prices to protect margins. Retailers will need to quantify the first margin on their purchases and strive, through attention to the buying, to lift the first margin on all purchases. A return to onshore manufacturing, in core items, may be an option if the Australian dollar falls to 75cents as is predicted. Retailers must be hungry for improved first margin.

- Managing markdowns in the business will test retailers and their retail management systems (RMS). Setting markdown budgets, to clear inventory, is as important as sales and purchase budgets. Learning outcomes from that process are critical in minimising future buying errors for your customers.

- Setting an Open to Buy (OTB) by month by category requires a committed management team and quality data from the RMS or POS systems. The OTB plan quantifies how much to “spend” or buy in each category based on sales, markdowns and inventory levels. The resultant forecast allows buyers to “see” the implication of their actions on the outcomes in the business. This is the fundamental discipline in retailing. If you do not have a buying plan by category then you are planning to fail.

- Building a strong product range and margin plan (with the OTB available) that allows for review of product criteria, applicable to your business, must be a prerequisite before orders are placed. Customer market segment, colour, size, brand, and product features need to be fine-tuned before placement of your orders. Continued refinement will allow mistakes in the range plan to be minimised. This means you must become a “buying agent for your customers not a selling agent for your suppliers”. No longer should you be a passive stake-holder in the product selection process but have a clear focused range plan for your categories. Depth in core items, and an understanding of fashion, everyday wear and replacement items in the business. Remember the 80:20 rule that 80% of your product sales will come from 20% of the inventory. Get this right and you can sell more off less!

- Final gross profit margin that pays the bills and delivers profit to the business must be protected. With a first or buying margin in the low fifty’s a final gross profit below 47% must be unacceptable to all retailers. Increasing expenses in the business will challenge the best retailers and final gross profit margins must be protected by improved buying disciplines.

Further articles will provide some guidelines in implementing retail management disciplines as outlined above. Remember retailing is in the DETAIL!

Building a strong vibrant product offer to survive tough retail trading conditions.

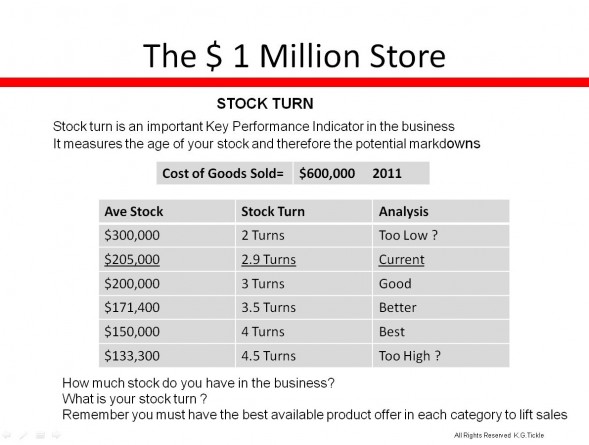

The importance of inventory management must be the prime focus of retailers in 2015. The open to buy process by category with a retail business will bring about improved inventory levels and stock turn. The following diagram shows a typical retail store doing $1 million in turnover. Assuming a 40% final GP (that is, cost of goods $600,000 therefore GP $ is $400,000.) Let’s assume average stock at cost is $205,000 therefore a stock turn of 2.9 is achieved. If you can manage the inventory to a better stock turn of 4 turns then stock can be reduced from $205,000 to $150,000 a saving of $55,000 – that ends up in your BANK ACCOUNT!

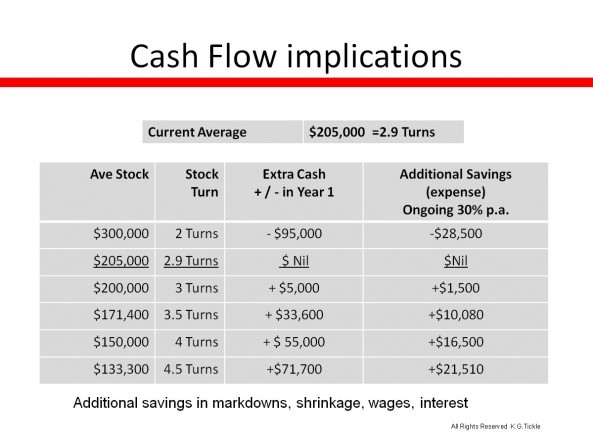

The following table demonstrates how improved stock turn in the business will deliver improved cash flow. It has been estimated in retail case studies that overstock can add up to 2.5% per month or 30% per year in additional costs to the business. Increased handling, rental storage requirements, damaged stock, stocktaking costs all add up to increase expenses in a retail business where inventory levels are higher than they need to be. The following table demonstrates that by reducing stock levels to $150,000 by improved category management, managing markdowns, implementing an Open to Buy plan, and building a well thought our range option plan you can sell the same amount from less stock. The table shows a $55,000 saving in stock holdings and a reduction of $16,500 ($55,000 times 30% p.a. cost of excess stock) in ongoing expenses in the business.

Buying disciplines within the business not only lower inventory levels but will also lift your final Gross Profit through improved first margin and less markdowns.

“You must become a buying agent for your customers, not a selling agent for your suppliers”

Ken Tickle

B Comm (NSW) FCPA

Retail Management Accountant

www.mfp.net.au

Email: ktickle@mfp.net.au

Mob: 0419 419 634